pa tax payment forgiveness

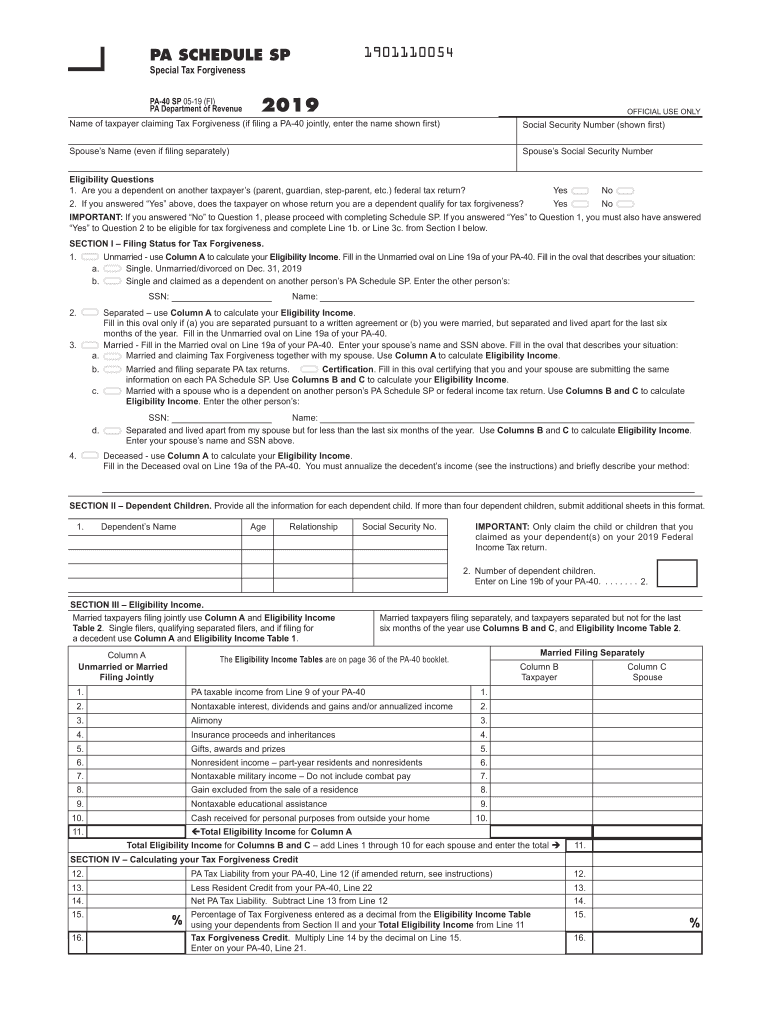

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Prepare And Efile Your 2021 2022 Pennsylvania Tax Return

How do I pay back taxes in PA.

. Go to the myPATH portal or via telephone at 1-800-2PAYTAX 1. Affordable Reliable Services. Affordable Reliable Services.

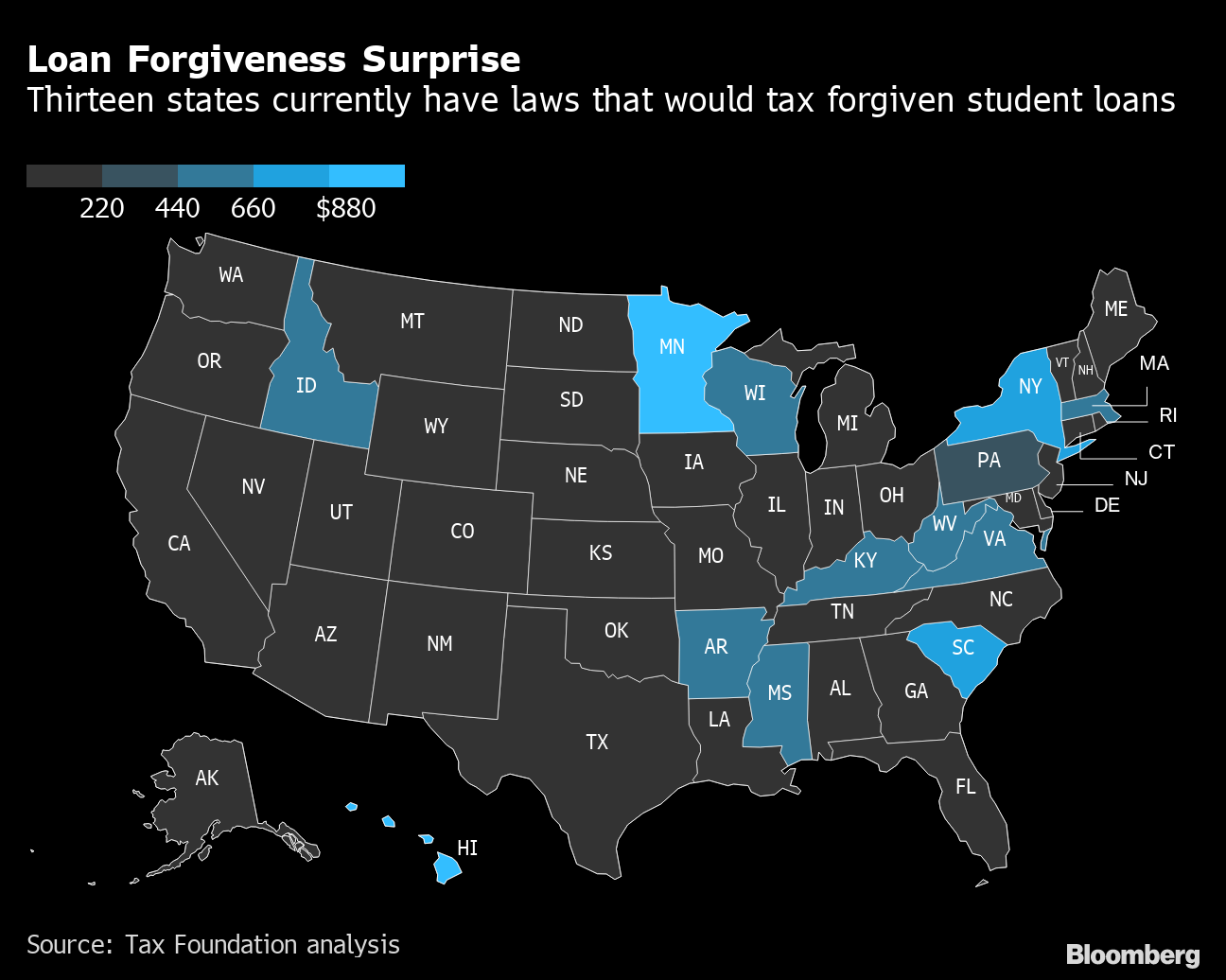

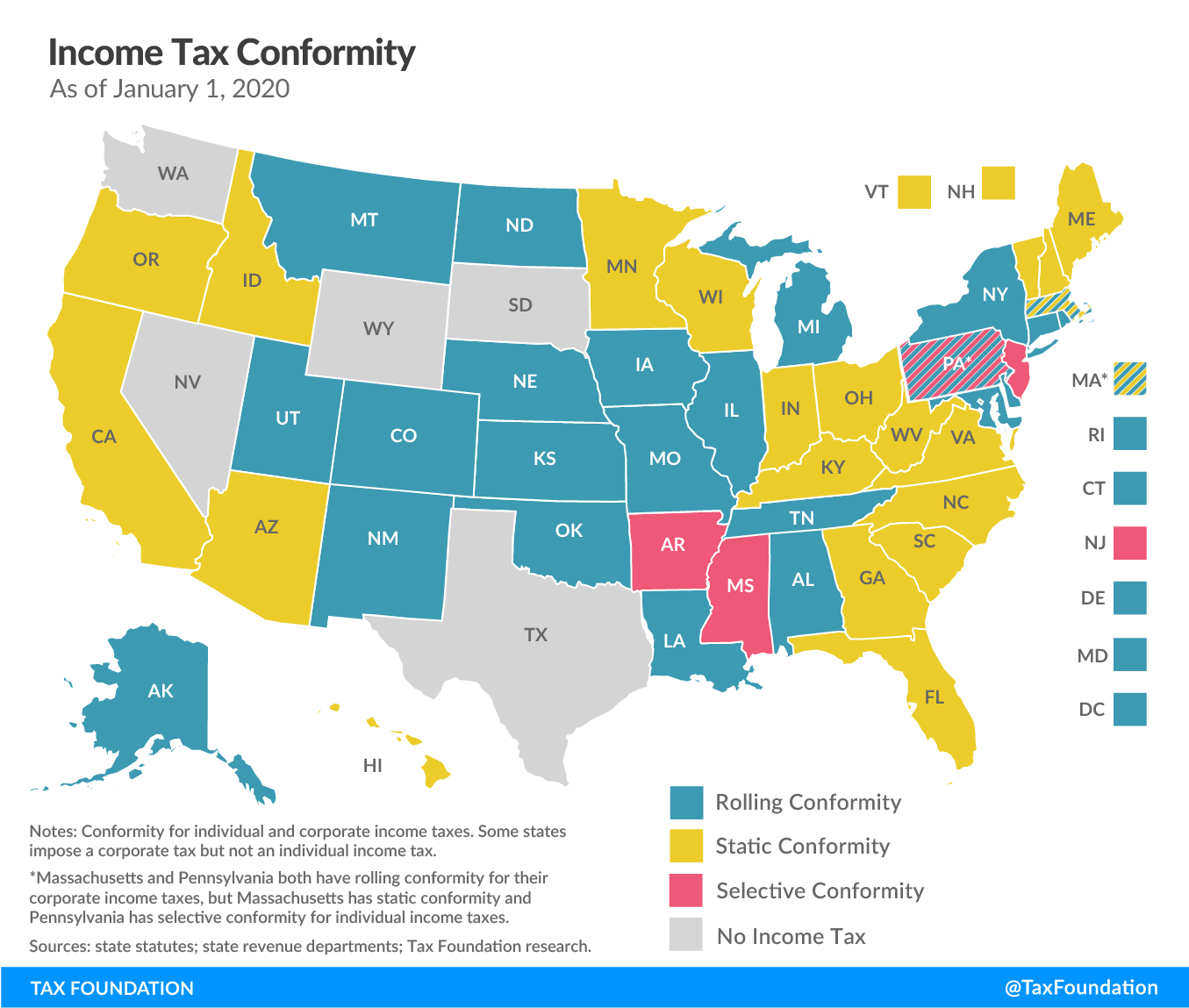

Take Advantage of Fresh Start Options. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Seven states might tax borrowers on student loan forgiveness.

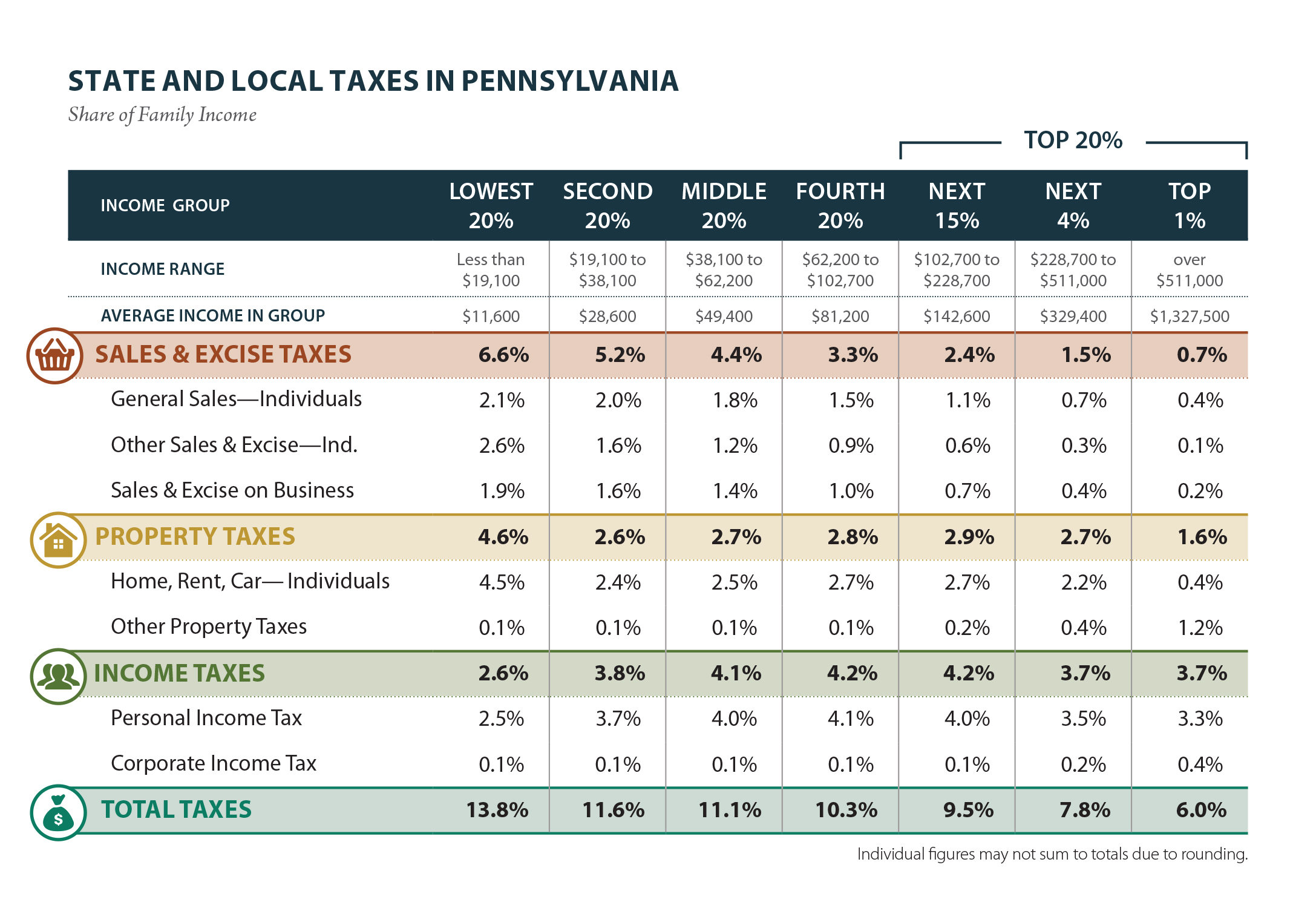

Wolf notes that for a public service worker with 50000 in forgiven student loans in Pennsylvania will now be able to avoid a 1535 state income tax bill. However any alimony received will be used to calculate your PA Tax Forgiveness credit. Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income.

Provides a reduction in tax liability and. Economy Education National Issues Press Release. Ad Possibly Settle for Less or Get Most Affordable Payment Plan.

Pennsylvania is not one of them Governor Tom Wolf says. Ad Tax forgiveness credit pa. A payment can be made by credit or debit card through ACI Payments Inc.

See if You Qualify. Check Out the Latest Info. Governor Tom Wolf today reminded Pennsylvanians that student loan borrowers who will receive up to.

Ad Possibly Settle for Less or Get Most Affordable Payment Plan. Tax Forgiveness Credit Pa. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax.

Browse Our Collection and Pick the Best Offers. Ad Apply For Tax Forgiveness and get help through the process. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

See if You Qualify. Take Advantage of Fresh Start Options. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program.

Pennsylvania has not been taxing student loan. Find Fresh Content Updated Daily For Tax forgiveness pa. What is a Pennsylvania tax forgiveness credit.

August 31 2022. To claim this credit it is necessary that a taxpayer file a PA-40.

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Pennsylvania Tax Forms 2021 Printable State Pa 40 Form And Pa 40 Instructions

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Pa Eliminating State Income Tax On Student Loan Forgiveness

These States Are Waiving State Taxes For Student Loan Forgiveness

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Small Business Loan Forgiveness Will States Tax Sba Ppp Loans

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Pennsylvania State Tax Updates Withum

Pennsylvania Department Of Revenue Depending On Your Income And Family Size You May Qualify For A Refund Or Reduction Of Your Pennsylvania Income Tax Liability With The State S Tax Forgiveness Program

Pennsylvania Residents Could Pay Taxes On Their Student Loan Relief

Student Loan Forgiveness Programs No Longer Subject To Pa State Income Tax Fox43 Com

Pa To End State Tax On Student Loan Forgiveness Pahomepage Com

Good News Pennsylvania Won T Tax Your Student Loan Forgiveness After All Pennlive Com

Pennsylvania State Tax Software Preparation And E File On Freetaxusa

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

Pennsylvania Department Of Revenue With The Personal Income Tax Filing Deadline Approaching On May 17 2021 The Department Of Revenue Is Reminding Low Income Pennsylvanians That They May Be Eligible For A

Pennsylvania State Tax Software Preparation And E File On Freetaxusa